For months we’ve been posting updates on the real estate market which up until recently has impacted the local and statewide markets by the higher than anticipated taxes, rising insurance premiums, interest rates and the election. While those factors alone led for a decline in sales and sales prices for most of the state, the devastating effects of the hurricanes over the past few months have had a unique impact of their own, especially to our local markets.

Typically this time of year we not only focus on the year to year sales comparisons, but the year to date recap as well, however, adding in the variable of multiple hurricanes are skewing the numbers resulting in fewer showings, inventory that was damaged or lost this year versus last, and listing prices decreasing. While we would typically see more inventory coming on the market this time of year in anticipation for the upcoming season and the arrival of our winter visitors, we are also seeing a significant number of inquiries by investors looking for opportunistic buys. Unlike Hurricane Charley where Money and Forbes magazines had just voted our area as one of the best places to retire that created an unique competition between investors and buyers vying for limited inventory, there is plenty of inventory for buyers and investors of all types. The silver lining for some is if their homes have not been impacted by the recent storms, those homes will be viewed more favorably and the potential is for shorter times on the market if priced competitively. For others who did not fare as well, keep in mind there is a 50/50 rule that will impact your recovery plans. When in doubt call a reputable contractor to give you an estimate, and who can also determine if any of your damage was wind related or just caused by rising water. Before making any decisions check with your accountant and financial advisor as they will help you decide if rebuilding is a viable option or selling the property “AS IS” is your wisest financial choice.

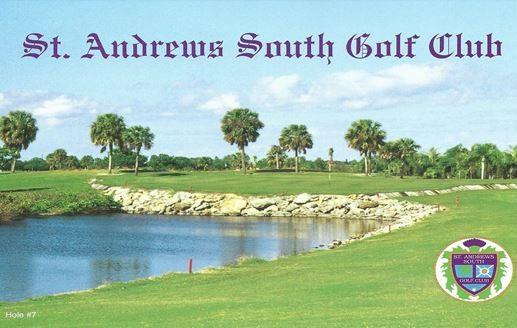

Almost two years ago, my wife signed us up as members of St. Andrew’s South Golf Club, as it occurred to her I was spending too much time sitting behind a computer or working late into the evening, and my only outlet was doing yard work. Somewhere along the way, I became my father! I wasn’t doing anything fun in my spare time. Try explaining that to someone who spends half their year bundled up during the winter months, and they’ll think you lost your mind when you live on the water and close to a host of golf courses. Sure, there are more challenging courses than St. Andrews; for years, when asked why I didn’t join, I would tease and tell them that due to the relatively flat terrain of the course, that’s where they used to host the areas Greyhound races. Now before you think, “This guy must be some golfer,” let me tell you this course has gotten the better of me in more ways than one. While St. Andrew’s South may not be hosting the U.S. Open anytime soon, this club is second to none in terms of the people we’ve met and the friends we’ve made.

Almost two years ago, my wife signed us up as members of St. Andrew’s South Golf Club, as it occurred to her I was spending too much time sitting behind a computer or working late into the evening, and my only outlet was doing yard work. Somewhere along the way, I became my father! I wasn’t doing anything fun in my spare time. Try explaining that to someone who spends half their year bundled up during the winter months, and they’ll think you lost your mind when you live on the water and close to a host of golf courses. Sure, there are more challenging courses than St. Andrews; for years, when asked why I didn’t join, I would tease and tell them that due to the relatively flat terrain of the course, that’s where they used to host the areas Greyhound races. Now before you think, “This guy must be some golfer,” let me tell you this course has gotten the better of me in more ways than one. While St. Andrew’s South may not be hosting the U.S. Open anytime soon, this club is second to none in terms of the people we’ve met and the friends we’ve made. Having been a Realtor for 18 years, we’ve helped many clients over those years navigate inspection reports and repairs so they can enjoy a smooth closing. We’ve learned a great deal from inspectors and contractors alike, and the difference between a repair and replacement. So you can imagine my frustration when our insurance field adjuster went on our 18-year-old roof and after surveying all the broken tiles said, “This can be repaired.” When I asked him about all the loose tiles he missed he replied, “Let me know if you see anything and I’ll add it to my report.” Anyone who knows me, knows I don’t like heights. Unless my roof was the height of my dining room table I wasn’t going to climb my roof to point out all the tiles he missed….thus began my “Art of War.”

Having been a Realtor for 18 years, we’ve helped many clients over those years navigate inspection reports and repairs so they can enjoy a smooth closing. We’ve learned a great deal from inspectors and contractors alike, and the difference between a repair and replacement. So you can imagine my frustration when our insurance field adjuster went on our 18-year-old roof and after surveying all the broken tiles said, “This can be repaired.” When I asked him about all the loose tiles he missed he replied, “Let me know if you see anything and I’ll add it to my report.” Anyone who knows me, knows I don’t like heights. Unless my roof was the height of my dining room table I wasn’t going to climb my roof to point out all the tiles he missed….thus began my “Art of War.” How do you know which roofer is being honest with you and not just looking to gouge the insurance company, when all you need is a repair? What about all the other damage to your pool cage or other items that were destroyed? It starts with having a good insurance broker who can guide you through the claims process. Then if you aren’t fortunate enough to get an adjuster who is keeping your best interests in mind, you have to get as many opinions and references as possible before signing anything. Whatever you do, don’t sign over your benefits, otherwise known as A.O.B., and not to be confused with New York Congresswoman A.O.C.

How do you know which roofer is being honest with you and not just looking to gouge the insurance company, when all you need is a repair? What about all the other damage to your pool cage or other items that were destroyed? It starts with having a good insurance broker who can guide you through the claims process. Then if you aren’t fortunate enough to get an adjuster who is keeping your best interests in mind, you have to get as many opinions and references as possible before signing anything. Whatever you do, don’t sign over your benefits, otherwise known as A.O.B., and not to be confused with New York Congresswoman A.O.C. A.O.B. is the acronym for “Assignment Of Benefits” and some people have unwittingly fallen victim to signing these over to a third party, who can be a roofing contractor or someone claiming to be working in your best interests. For those of you unfamiliar with the process, by signing over your claim benefits you are now on the outside looking in as all decisions and reimbursements will be going to the third party. You are no longer in control of your insurance benefits or reimbursements. In Florida, you do have a 14-day rescission period in which to cancel that agreement, but it is best to seek the advice of an attorney or your insurance broker before signing anything. Some people will automatically engage the services of a public adjuster to fight their battles. I look at this as more the last option than my first. Public adjusters on average will make ten percent of the total claim. If the insurance company doesn’t reimburse you enough to cover their “commission” you are on the hook. If you have a deductible of $5,000-10,000 and you have $60,000-100,000 in damages, and the insurance company is only looking to cover the cost for damages and nothing more, you could be out of pocket another $6,000-10,000 on top of your deductible. Another thing to consider is the contract you are signing with a roofer. Are you bound to them regardless of whether they get enough money to complete your roof repair or replacement, or are you responsible to make up the difference? Questions you need to ask aside from getting a quote and an estimated time of completion to complete the job are 1. Is there a cancellation period in the contract should I decide to terminate this agreement? 2. Am I bound to you if the insurance company is unwilling to agree to your estimate?

A.O.B. is the acronym for “Assignment Of Benefits” and some people have unwittingly fallen victim to signing these over to a third party, who can be a roofing contractor or someone claiming to be working in your best interests. For those of you unfamiliar with the process, by signing over your claim benefits you are now on the outside looking in as all decisions and reimbursements will be going to the third party. You are no longer in control of your insurance benefits or reimbursements. In Florida, you do have a 14-day rescission period in which to cancel that agreement, but it is best to seek the advice of an attorney or your insurance broker before signing anything. Some people will automatically engage the services of a public adjuster to fight their battles. I look at this as more the last option than my first. Public adjusters on average will make ten percent of the total claim. If the insurance company doesn’t reimburse you enough to cover their “commission” you are on the hook. If you have a deductible of $5,000-10,000 and you have $60,000-100,000 in damages, and the insurance company is only looking to cover the cost for damages and nothing more, you could be out of pocket another $6,000-10,000 on top of your deductible. Another thing to consider is the contract you are signing with a roofer. Are you bound to them regardless of whether they get enough money to complete your roof repair or replacement, or are you responsible to make up the difference? Questions you need to ask aside from getting a quote and an estimated time of completion to complete the job are 1. Is there a cancellation period in the contract should I decide to terminate this agreement? 2. Am I bound to you if the insurance company is unwilling to agree to your estimate? While I’ve been sharing my experience with a roofer and an insurance company that seems more concerned with their interests than helping us through this time, there is a reason many of you may be experiencing what we are. Ask any insurance broker how many questionable claims for new roofs were submitted years after Hurricane Irma impacted Florida. They’ve shared with us the weather-related causes we just didn’t experience, but that it was cheaper to pay the claim than battle in court. As a result, insurance companies are now insuring roofs for less time than the projected lifespan from the manufacturer. On average, an insurance company will insure a shingle roof for 10-15 years, a tile roof for 20-25 years, and a metal roof for 25-30 years before requiring you to replace it to continue coverage. The question becomes, “Is the insurance company looking to “repair” when you need a replacement, knowing in a few short years you’ll need to incur the cost of replacement yourself?” The important thing to keep in mind is to get several estimates from respectable contractors who have good reviews and standing with the Better Business Bureau. For those living in the general area, you can always reach out to the Charlotte Desoto Building Industry Association otherwise known as the CDBIA. They are comprised of local contractors, lenders, and related trades and services that can give you guidance and resources when needed. While none of us want to wait for a prolonged period to get our homes put back together, don’t feel pressured to sign a contract until you’ve thoroughly researched the company and the contract. Our understanding is you have up to a year to file a claim, but check with your insurance broker to verify the details of your policy.

While I’ve been sharing my experience with a roofer and an insurance company that seems more concerned with their interests than helping us through this time, there is a reason many of you may be experiencing what we are. Ask any insurance broker how many questionable claims for new roofs were submitted years after Hurricane Irma impacted Florida. They’ve shared with us the weather-related causes we just didn’t experience, but that it was cheaper to pay the claim than battle in court. As a result, insurance companies are now insuring roofs for less time than the projected lifespan from the manufacturer. On average, an insurance company will insure a shingle roof for 10-15 years, a tile roof for 20-25 years, and a metal roof for 25-30 years before requiring you to replace it to continue coverage. The question becomes, “Is the insurance company looking to “repair” when you need a replacement, knowing in a few short years you’ll need to incur the cost of replacement yourself?” The important thing to keep in mind is to get several estimates from respectable contractors who have good reviews and standing with the Better Business Bureau. For those living in the general area, you can always reach out to the Charlotte Desoto Building Industry Association otherwise known as the CDBIA. They are comprised of local contractors, lenders, and related trades and services that can give you guidance and resources when needed. While none of us want to wait for a prolonged period to get our homes put back together, don’t feel pressured to sign a contract until you’ve thoroughly researched the company and the contract. Our understanding is you have up to a year to file a claim, but check with your insurance broker to verify the details of your policy.

I always thought of myself as a real summer kid. Growing up in New York I was willing to sacrifice all the other months just to get to the summer season that started with Memorial Day and ended on Labor Day. That’s when I felt the most alive, and it was almost like watching life through a black and white t.v. that just transitioned to color. While my father claimed his favorite time of year was the fall, he would often say, “If you took out January, February, and March you would have perfect weather.” With a puzzled look on my face, I would reply, “You just cut out a quarter of the year like it was nothing.” Then I thought to myself, “I was willing to give up three quarters of the year just to get to my favorite 3 months.” I had to ask myself, “Which of the two of us was really nuts?”

I always thought of myself as a real summer kid. Growing up in New York I was willing to sacrifice all the other months just to get to the summer season that started with Memorial Day and ended on Labor Day. That’s when I felt the most alive, and it was almost like watching life through a black and white t.v. that just transitioned to color. While my father claimed his favorite time of year was the fall, he would often say, “If you took out January, February, and March you would have perfect weather.” With a puzzled look on my face, I would reply, “You just cut out a quarter of the year like it was nothing.” Then I thought to myself, “I was willing to give up three quarters of the year just to get to my favorite 3 months.” I had to ask myself, “Which of the two of us was really nuts?” While most people would like to talk about themselves, Gary and Gail have always put their clients first, and their diverse backgrounds have provided their clients an unparalleled level of service and knowledge throughout the past years.

While most people would like to talk about themselves, Gary and Gail have always put their clients first, and their diverse backgrounds have provided their clients an unparalleled level of service and knowledge throughout the past years.